Article

Telecom Sub-brands on the Rise: Maximizing Emerging Market Potential

A new trend has emerged in the telecommunications sector in recent years: Telecom operators are launching one or even multiple sub-brands. This trend has reached emerging markets as well.

For example, Orange Maroc launched “Yoxo” in February 2022 in Morocco. This 100% digital sub-brand is aimed at young customers and offers online customer support via chat and a WhatsApp virtual assistant. In Algeria, Ooredoo launched “Yooz” in 2021, an app-based sub-brand that attracted over 155,000 subscribers, offering zero-rated music and video streaming services, data plan customization and discounts for partner services. Why are such sub-brands popping up today? Telecom operators can leverage them to tap into new customer segments and protect their existing customer base from aggressive mobile virtual network operator (MVNO) entrants.

Sub-brands disrupt the traditional telecom landscape by catering their product offering and go-to-market approach to specific target audiences and, therefore, by providing higher value to their customers in comparison with a cookie-cutter approach. They have been able to gain significant market share by leveraging their agility and cost-effectiveness, two factors that have enabled them to rapidly expand their customer base.

Sub-brands ramp up quickly: Well-established sub-brands account for more than 10% of the customer base of a mobile network operator (MNO) and gain up to 23% of the customer base in the first 12 months [1]. Even though sub-brands are hardly a novelty in the telecommunications market and were launched by several MNOs during the past decade, the potential in emerging markets is still widely untapped.

Market overview and advantages

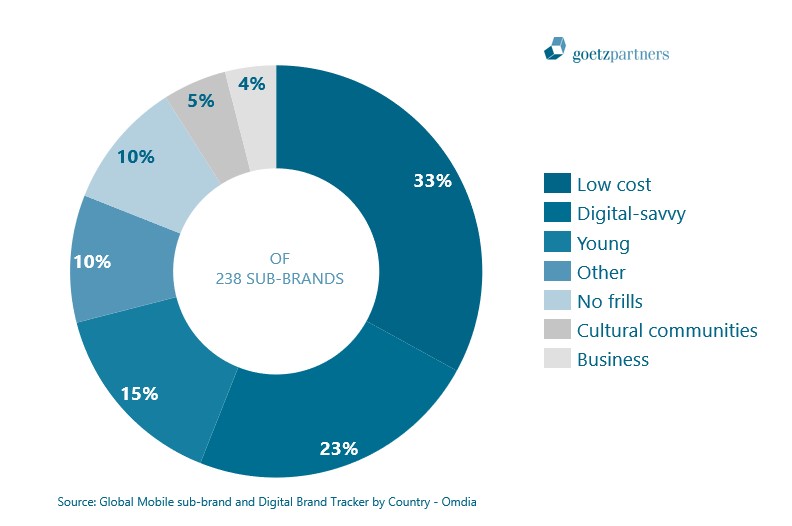

In 2023, a staggering total of 238 sub-brands were operated by 18% of all telecom service providers worldwide:

Figure 1: Sub-brands broken down by target groups 2023

One of the main drivers behind the rise of sub-brands is the need for MNOs to address underserved target groups, compete with low-cost operators and protect their main brand's position in the market. Moreover, by migrating lower-value customers to sub-brands, operators can also retain ARPU levels in their main brands. One common approach is to target low-cost customers and digital savvy-customers, accounting for more than half of sub-brand strategies.

Another advantage of sub-brands is their ability to grow with lower acquisition costs per customer (~50%) and to obtain a robust customer base very quickly – up to 23% of the customer base in the first 12 months [1]. An agile and solely digital approach enables operators to set up a leaner organization and attract digital-savvy consumers, which is the second-biggest target group with a growth rate of +5 p.p. since 2020 [2]. These consumers are comfortable interacting in an online-only environment but demand a seamless digital user experience in return.

Sub-brand potential in emerging markets

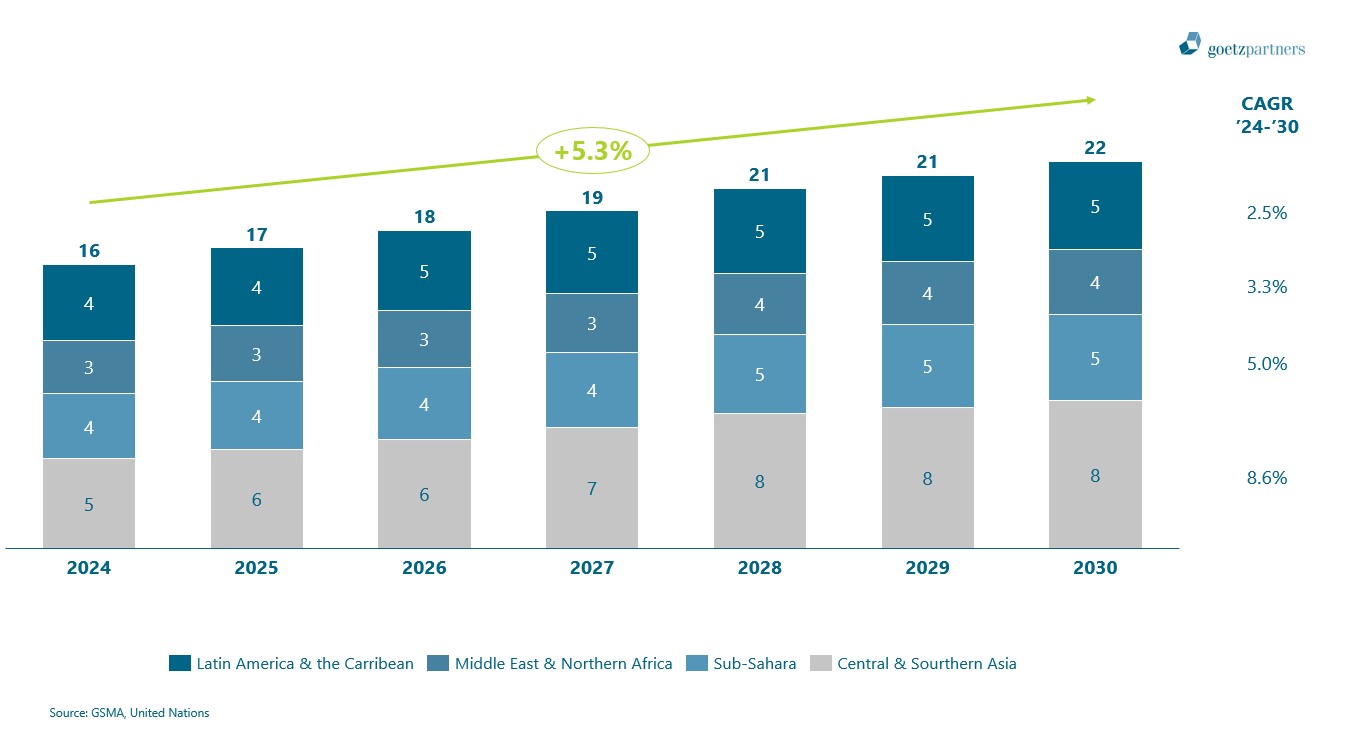

The landscape of sub-brands in the telecommunications industry reveals distinct regional patterns. About three-quarters of the MNOs in North America (75%) and more than half of MNOs in Western Europe (53%) manage sub-brands [2]. Notably, Morocco and Algeria introduced their inaugural sub-brands in 2019 and 2021, respectively [2]. In the Middle East, the adoption rate climbed to 18% in 2023, marking a rise from the 11% recorded in 2020 [2]. Looking ahead, the potential across all emerging markets is substantial, with an estimated market size exceeding $22 billion by 2030 [3].

Figure 2: Addressable market emerging markets (in revenues in $ bn)

Key questions and go-to-market approach

A sub-brand can be created either through an internal launch within the company or the acquisition of an existing MVNO. Regardless of the path chosen, six critical issues must be addressed before progressing further:

- Will a sub-brand drive customer acquisition and provide added value to under-served customer segments?

- Will a cannibalization effect occur and, if so, to what extent? Is a pre-emptive self-cannibalization strategy worth exploring?

- What challenges in the existing organization, customer base and infrastructure could hinder launching a sub-brand?

- Which sub-brand value proposition models (fully-digital sub-brand, end-to-end low cost provider) provide a cost advantage?

- Which opportunities in the existing operating model can be leveraged?

- Does the company have the capabilities to deploy a rapid test-and-learn approach?

Following careful consideration of these questions, the strategy and go-to-market approach can be defined by five key components:

- Definition of vision and strategy as well as effective project setup

- Identification of target segments and derivation of customer personas

- Development of the product portfolio and pricing plan

- Creation of a marketing and brand concept

- Setting up of sales channels and design of optimal customer journeys

Summary

Overall, sub-brands have become an effective way for telecom service providers to reach new customers and address specific segments while protecting their main brand’s market position. With their digital-native and lifestyle-oriented approach, sub-brands can continue to grow and compete in an ever-changing market.

When establishing a sub-brand, whether through internal launch or acquisition of an existing MVNO, it’s essential to first address key questions related to customer acquisition, cannibalization, challenges, value proposition models and capabilities. These considerations guide the formulation of the strategic approach encompassing vision, target segments, product portfolio, marketing and sales channels.

Many success stories are already showcasing the potential of sub-brands and are offering valuable insights to those interested. In particular, emerging markets offer a significant untapped opportunity, projected to exceed a market value of $22 billion by 2030. This potential is an exciting prospect for every service provider already based or interested in operating in these markets.

Authors:

Dr. Nima Ahmadi, Partner (Email)

Isabelle Güllüoglu, Melanie Heßlinger, Sven Plitzko

Sources:

[1] Omdia.

[2] Global Mobile sub-brand and Digital Brand Tracker by Country – Omdia.

[3] GSMA, United Nations 2023.