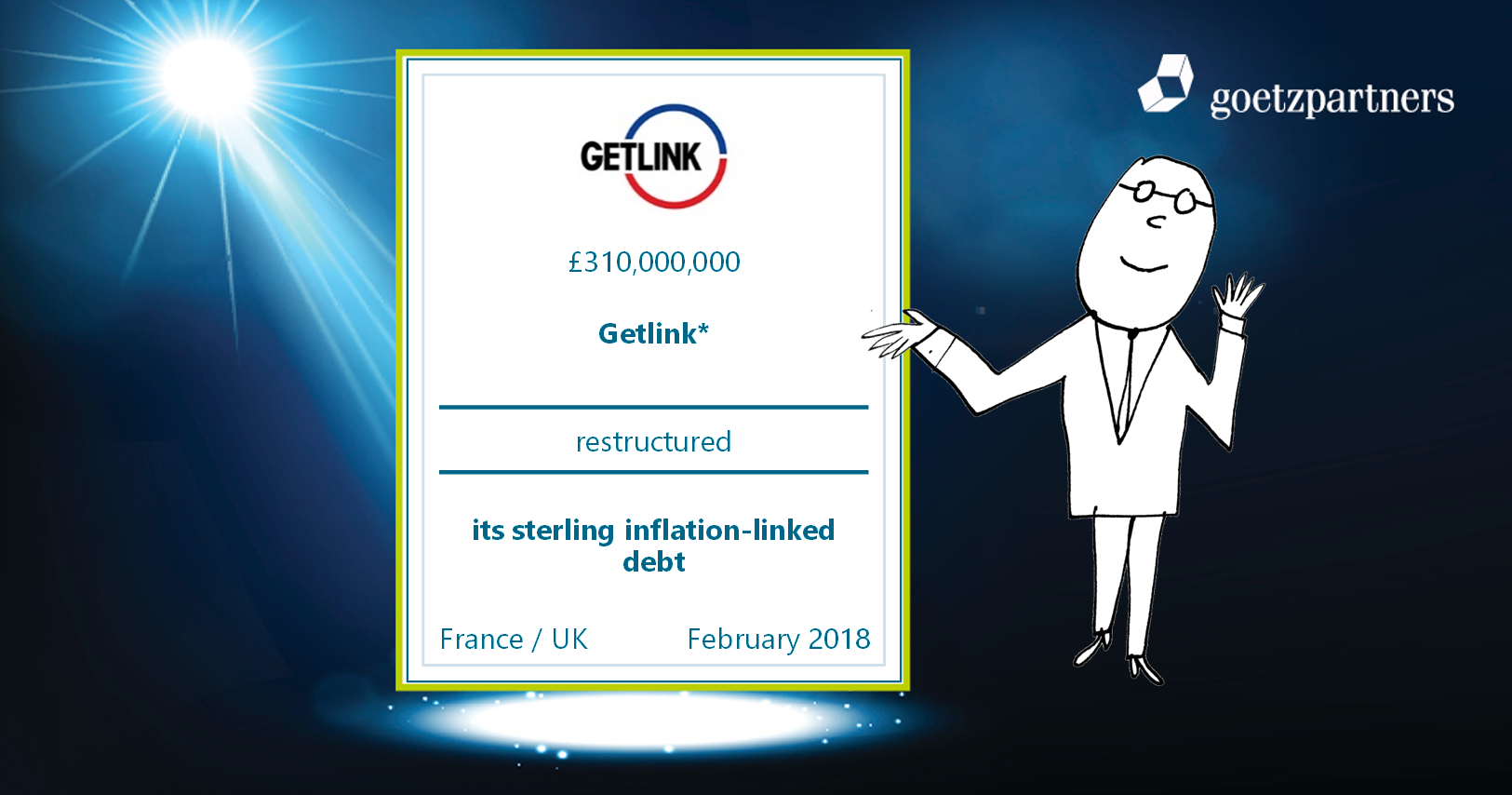

Deal Announcement

goetzpartners has advised Getlink on the restructuring and refinancing of its sterling inflation-linked debt

On 7 February 2018, Getlink announced having successfully restructured its sterling inflation-linked debt implemented in 2007. By executing its agreement with FMS(1) the Group purchased part of the sterling inflation-linked bonds and will have the option, up to 2025, to acquire any or all of the outstanding bonds owned by FMS.

After the removal of two monolines in December 2015 and the refinancing of the floating-rate debt in May 2017, this transaction is the last landmark step in the Group’s debt structure optimization process. It will notably enable the Group to proceed to its legal reorganization through ring-fencing the entities which operate the Fixed-Link business (Eurotunnel) from those operating the other Group businesses. This new structure will give financing flexibility to the Group.

goetzpartners advised Getlink in the negotiations with FMS and the structuring and completion of the transaction.

Jacques Gounon, Chairman and Chief Executive Officer of Getlink, said: “I am particularly pleased with this development which, by ring-fencing the Fixed-Link, concludes the Group's debt transformation, and will enable ElecLink to partially fund itself through its own asset potential.“

Serge Prager, Managing Director at goetzpartners, said: “We are very proud to have worked on this landmark transaction, after advising Getlink on its previous major debt restructuring transaction last May. It shows our commitment towards our clients and our ability to work with them throughout their strategic transformation.“

(1) German state-owned structure holding most of the sterling inflation-linked debt

goetzpartners Transaction Team

Serge Prager

Managing Director

Email

Léo Fallourd

Associate

Email