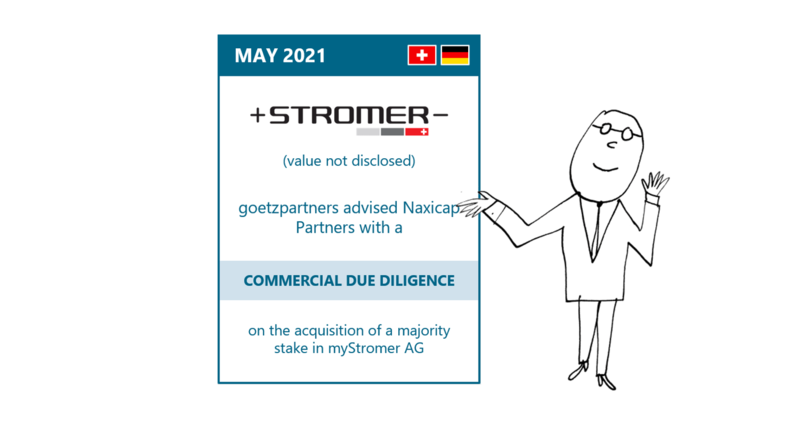

Deal announcement

goetzpartners advised Naxicap Partners

goetzpartners advised Naxicap Partners on the acquisition of a majority stake in Stromer with a Commercial Due Diligence

goetzpartners advised Naxicap Partners (“Naxicap”) with a Commercial Due Diligence on the acquisition of a majority stake in myStromer AG (“Stromer” or “the Company”), the leading manufacturer of premium speed pedelecs in Europe and the United States, with a market share of over 20 percent each country.

The Commercial Due Diligence included a comprehensive analysis of Stromer’s product portfolio and its market environment with a particular focus on the company’s differentiating edge compared to its competitors, which was validated on the base of a detailed price and technology benchmarking. goetzpartners evaluated the magnitude and sustainability of future growth expectations within Stromer's addressed market segments. In addition, the Commercial Due Diligence included a thorough analysis of Stromer's reseller network, which is a major cornerstone of the company's scalable go-to-market approach. Further, the Commercial Due Diligence provided a detailed top- and bottom-line Business Plan assessment and an integrated Value Creation Plan.

About Stromer

Stromer is based in Oberwangen, Switzerland and was founded in 2009 by Thomas Binggeli. It is the market leader in speed pedelecs, producing around 12,000 speed e-bikes (45km/h) per year at its Oberwangen site, and is shaping the future of mobility, delivering a contemporary mobility solution for commuters. The company employs around 140 people, has two subsidiaries (USA and Netherlands) and sells its products in 17 countries. At Stromer, "Swissness" represents a promise to always ensure quality, design, precision, reliability and respect for the environment. This is confirmed by the <200 million kilometres driven with Stromers. For further information, please visit www.stromerbike.com

About Naxicap Partners

Naxicap Partners - a subsidiary of Natixis Investment Managers - is one of the leading European private equity companies based in France and currently manages assets of approximately EUR 4 billion. As a committed and responsible investor, Naxicap Partners builds constructive and sustainable partnerships with entrepreneurs to ensure mutual success. The company has 40 investment professionals in five offices in Paris, Lyon, Toulouse, Nantes and Frankfurt. The investment company has been active in Germany since 2016. Since the opening of the Frankfurt office in 2018, the investment activities in German-speaking countries have been coordinated from there. Further information are available at www.naxicap.com

Transaction Team

Dr. Sigurd Kitzer

Partner

Email

Dr. Burak Yahsi

Manager

Edwin Steffan

Consultant

Amir Murathodzic

Associate Consultant

Rosa Frehen

Associate Consultant

Thomas Kotschi

Associate Consultant