Article

Rail liberalization in France

France is liberalizing its passenger rail market. Since 2019, French regions have been able to tender competitively for regional rail traffic. From 2023, competitive tendering will become mandatory. The liberalization is expected to increase value for money for French taxpayers as well as competition among rail operators and also rolling stock manufacturers. However, it is not only operators and manufacturers that will have to adjust to the new dynamic: The regions, now the purchaser of the services, need to acquire the capabilities to manage complex tender processes strategically and operationally.

As demonstarted by Germany, Denmark, and Sweden, liberalization can – when carried out strategically – lower prices and increase service quality. Based on dozens of supported processes, goetzpartners believes in great opportunities for all stakeholders in the French rail market.

Liberalization is reshaping the French passenger rail market

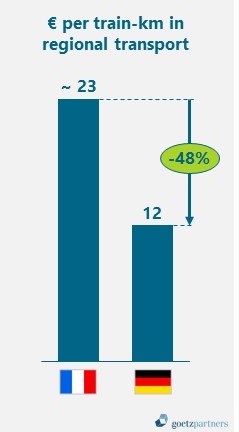

The French passenger rail system delivers more than 100 billion passenger-km per year. It is one of the largest rail markets globally and one of the infrastructure backbones of France. Until the liberalization, rail services had always been organized with limited competition. For operations, either the state-owned SNCF, RATP, or SNCF’s subsidy Keolis delivered the services with local manufacturers providing most of the rolling stock. This system resulted in significantly higher costs per run train-km in France than, for example, in Germany.

This system is currently changing: With the railway pact from 2018, the French government is introducing a stepwise liberalization of the French rail market. Since December 2019, French regions may either award contracts for regional rail passenger transport services (TER) through tenders or provide services themselves. In addition, the French state may award contracts for national rail passenger services (“Intercités”) following a call for tenders. From December 2023, the state and regions are generally obliged to publicly and competitively tender public service contracts for rail passenger transport services.

Liberalization implications for the French rail market – a blueprint from Germany?

goetzpartners accompanied the German liberalization processes from the beginning, and we assume that the French liberalization is substantially altering the French rail market and that it will continue to do so. Tendering models are about to change, a heterogeneous group of newcomers are entering the market and incumbents are having to fight for today’s market share. Operators and manufacturers will have to cope with increased complexity and uncertainty, and the tendering authorities (especially regions) must acquire the respective capabilities to manage complex tender processes.

The development of the German regional railway market might serve as an example for the challenges and opportunities facing France: Today, 27 regional rail transport authorities organize the regional rail services through competitively tendering in Germany.

Over more than 20 years, these German authorities have introduced innovative new tender models customized to their specific requirements and objectives (e.g., regarding maintenance strategies, rolling stock design, financing, payment schemes, service levels, etc.). While some set-ups have turned out to be too competitive or shifted too many risks to private entities, the overwhelming majority of the more than 150 networks operate smoothly.

As a result, rolling stock fleets in Germany have been modernized, maintenance facilities upgraded, and rail networks extended – while prices per train kilometer have relatively decreased. In total, passenger volumes have increased substantially (>100%). Market entrants such as Transdev, Netinera, Benex, Abellio, and Keolis now own approximately 35% of the market share, while the incumbent Deutsche Bahn still holds approximately 65%.

The German example proves that rail market liberalization can considerably improve rail services for passengers if done correctly.

The protagonists in France and their prospective challenges

And France’s mission is just about to start. However, on its path to competitive rail tendering, the rail systems’ stakeholders may face some challenges, as tender designs must be as follows:

- aligned with the long-term strategy of the regions – technically and economically – as contracts and assets create path dependency for decades,

- allow for competition regarding quality and not only price – a mere “numbers-based” evaluation is tempting as it seemingly reduces legal risks for the contracting authority, and

- consider an efficient allocation of risks among all contracting parties.

Hence, all players along the value chain must develop the structures, processes, and capabilities required to develop a sustainable and efficient rail system.

- REGIONS

Competitive tendering at the level required is a multifaceted challenge and new for many stakeholders. If done correctly, quality can be increased, and costs decreased. Regions must cope with changing legislation, develop coherent, long-term strategies, design rolling stock and maintenance policies, introduce new financing/pricing regimes, and manage respective tender projects over several years. This is not merely a legal or engineering question, but rather a strategic multibillion euro one! - OPERATORS

The operator landscape is expected to become more heterogeneous. Incumbents face new competition, and with competition, prices per km are expected to decrease and hence pressure margins. Newcomers require laser focus and substantial value propositions in order to offer both competitive and profitable bids in competition with established operators – the latter still profit from close relationships with essential stakeholders and existing infrastructure (e.g., maintenance shops). - ROLLING STOCK MANUFACTURERS

Two operators – SNCF and RATP – dominate the French rail market. They are long-standing players and still benefit from long-term framework contracts and existing infrastructure or fleets. On the one hand, additional market growth is expected through liberalization as fleets will be modernized and new operating models may be introduced (e.g., similar to DSB in Denmark or RRX in Germany). On the other hand, manufacturers are expected to face increased pricing pressure with a generally higher weighting being placed on total lifecycle costs. This may further accelerate as newcomers increasingly compete with the incumbents. - FINANCIAL INVESTORS

With theliberalization of regional services, investors could seek opportunities to also participate in tenders, e.g., via consortia with operators and/or rolling stock manufacturers. Yet, investors entering competitive tendering processes in the French railway market is something new – and investors have to manage and align a heterogeneous group of partners and stakeholders with diverging interests in complex processes. Although market prospects are excellent, a degree of uncertainty (e.g., future price development) remains.

How to win in a liberalized French rail market

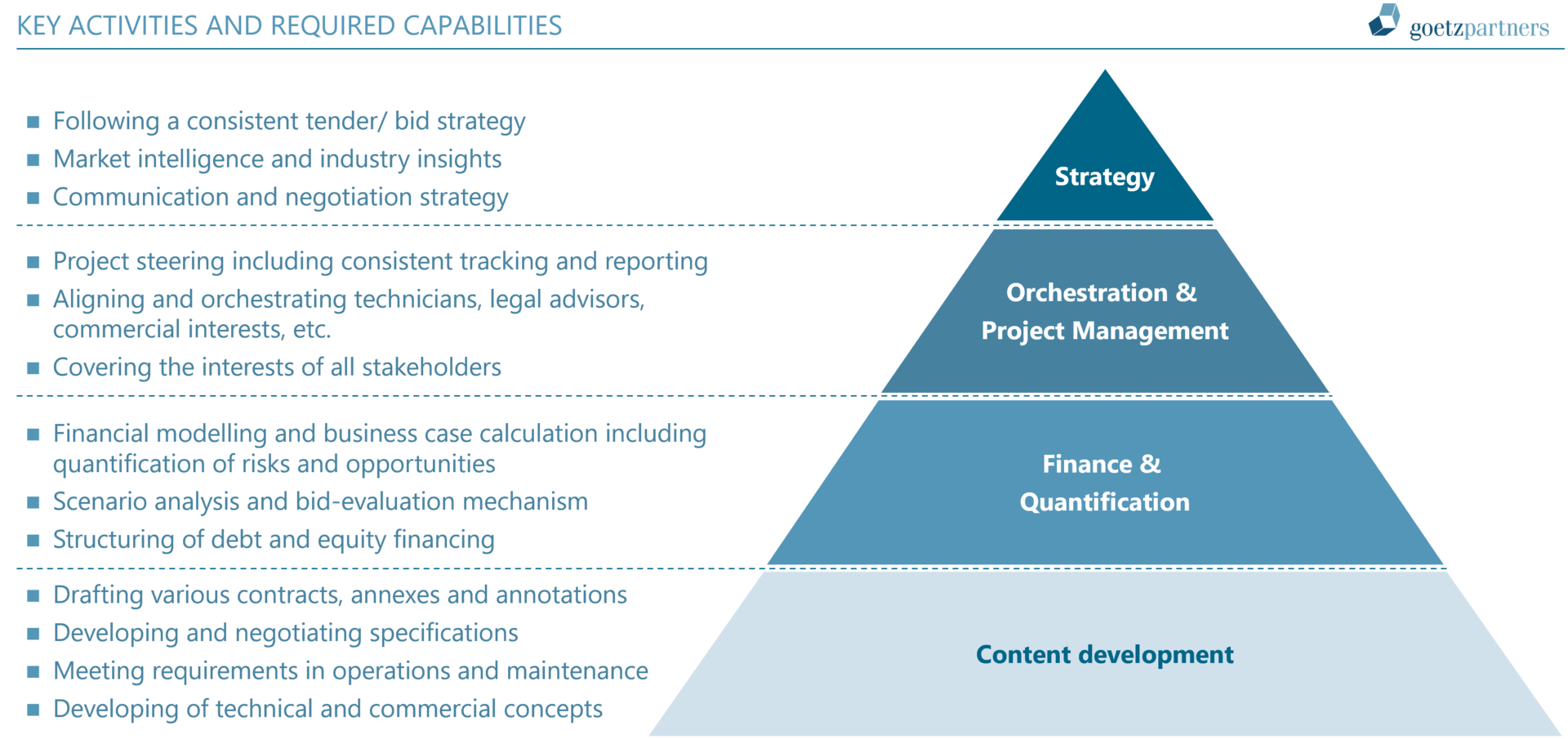

For all relevant players, highly competitive and strategic bidding and tendering in France is an entirely new discipline. Developing a powerful and flexible/agile tender/bid set-up is critical to tendering successfully or gaining/holding market share in France. To be successful, all players must therefore consider the following key activities and required capabilities:

The parties involved in the liberalization dynamic of the French rail sector face uncertainties. However, starting preparations now with a detailed and structured market exploration lays the necessary foundations for a substantially improved future positioning. If well-prepared, they are likely to be rewarded with promising opportunities.

Author:

Dr. Christian Wältermann, Head of Mobility & Infrastructure (Email)