Article

Power purchase agreements: mandatory product with hidden risk

The importance of power purchase agreements (PPAs) in the European energy market has steadily increased in the past years. The ambitious EU targets for decarbonizing the economy are accelerating the pace of renewable energy development. While subsidized feed-in tariffs were economically inevitable in the early years, these won’t be able to permanently provide total cost coverage. Hence, direct sales from power plants are becoming increasingly attractive.

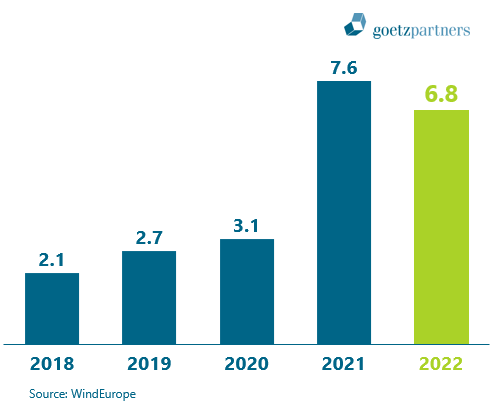

Figure 1: Annual PPA volume (MW)[1]

Power purchase agreements, which usually involve a long-term purchase agreement for renewable energy from a specific plant, are becoming an increasingly attractive and employed option for the sale of renewable energy (without subsidies). The contracted PPA volume more than tripled to 6.8 GW [see figure 1] in the past five years. Development of volumes is being driven, among other things, by electricity rates and economic growth.

Additional momentum for the PPA market may be expected from EU market discussions in which PPAs are being considered as one possible mechanism to foster investments in renewables and limit consumer risk. Hence, PPAs are here to stay and will play a major role in tomorrow’s energy markets.

The mutual insurance policy

As might be expected from the growth in volume, PPAs offer a range of benefits for both producers and customers. The key advantage of PPAs for both groups is the reduced price risk from fixed PPA prices, thus less uncertainty.

Market turbulence in recent years has painfully demonstrated the importance of hedging electricity prices. PPAs provide an attractive tool that customers can use to hedge long-term energy costs at an average price and smooth out price peaks in the process. In most cases, PPAs also include guarantees of origin documenting energy generation from renewables, a feature that is increasingly relevant to all stakeholders.

Long-term hedging also plays an indirect role for generators – in financing. The envisaged expansion of renewables requires immense amounts of capital, funding that cannot be generated by all incumbent utilities alone. For Germany, an estimated investment of more than 300 billion euros will be necessary through 2030. Hence, debt capital plays an integral role in project financing. Since successful amortization is mainly determined by electricity prices, a business case over 20+ years is associated with immense uncertainty. Provided that no other financial collateral is available, banks require the hedging of electricity prices to a certain degree to ensure stable, reliable cash flows and, thus, repayments.

Besides government-offered contracts for differences (CfD), PPAs provide another common tool to ensure price stability for both generators and consumers, a mutual insurance policy.

Stuck between utility and financial investor – risks associated with PPAs

While PPAs offer advantages to generators, they also come with several risks, some of which affect utilities in particular. Depending on the contract design, the extent and allocation of price, profile and volume, risk may vary between producer and customer. In addition, generators should also consider the following three risks:

- Portfolio risk: finding the right balance

Partially hedging generation of renewable assets is required to secure financing and reasonable to secure operational cash flows. While the hedging decision generally depends on the desired risk profile of the plant owner, utilities should consider that contracted volumes are effectively “gone” for about a decade. Thus, by hedging too much of their generation portfolio through PPAs, positive portfolio effects might be lost. The one perfect balance between PPA and “merchant” volumes doesn’t exist, but an individual corridor should be derived from a detailed portfolio analysis.

- Margin risk: gaining separation from financial investors

Once the entire generation of an asset is sold via PPAs, the “value creation” of a utility and financial investor no longer differs [2]. However, institutional investors typically have significantly lower costs of capital, thus representing the better owner. Utilities must differentiate themselves from financial investors through superior commercialization of the assets or realization of additional margins (e.g., cross selling bundle solutions). Competitive pressures will be brutal if they fail to do so.

- Counterparty risk: managing default risk

While PPAs help to reduce price uncertainty, the counterparty risk increases significantly. Depending on market price development one party will effectively always bear higher costs than on current spot markets. In cost sensitive industries, downward price shifts during the PPA lifetime might lead to severe profit crisis or even an insolvency risk of counterparties, resulting in renegotiations of the PPA price or eventually default. While this is no argument against PPAs per se, producers must prepare for the changing requirements in risk monitoring. Considerations by the EU to mitigate credit risk in connection with PPAs might present a silver lining.

Summary

Power purchase agreements are becoming increasingly relevant and can hardly be avoided by any energy producer. While PPAs offer several benefits, they also involve a range of risks. Utility companies must be aware of these risks and consider PPA volumes as part of an overall portfolio strategy.

Authors:

Dr. Klaus Grellmann, Managing Director (Email)

Frederik Sagolla, Florian Willke

Sources:

[1] https://windeurope.org/intelligence-platform/product/the-corporate-ppa-tool/

[2] Except through a combination with balance group management as an additional service.