Article

Between private & premium: Navigating Consumer Polarization in Food Manufacturing Strategies

Consumers are narrowing down their consideration set in major grocery categories between affordable private label products and branded premium ones. This divide is reflective of a broader dichotomy within consumer purchasing preferences and profiles. Food manufacturers should shape their strategy to fully exploit this trend.

Private label products are experiencing a surge as retailers invest in improving their quality to meet consumer demand and capture price points that have been left vacant due to price increases by branded products in the recent past. These products offer an economical alternative to consumers without significantly compromising on quality and are becoming attractive in the current macroeconomic environment. The substantial ground gained on the shelves by private label products compels branded product players to reevaluate their value proposition and positioning.

Italian branded product companies should resist the temptation to indiscriminately cut prices to maintain market share. Instead, they should focus on their unique and differentiating selling proposition, and continuing to address the considerable consumer segment that in Italy and abroad gravitates towards premium products.

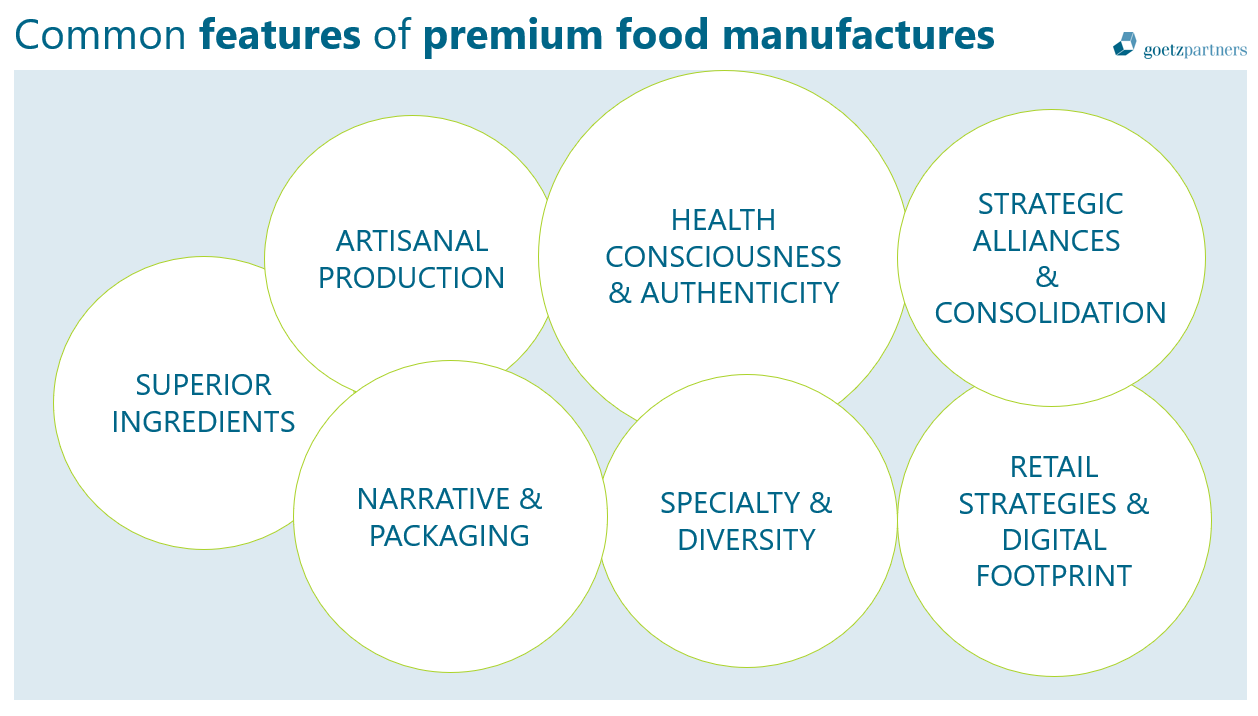

- Italian brand manufacturers should emphasise the use of high-quality raw materials and their sourcing from Italian regions renowned worldwide for their gastronomic specialities, as well as denomination of origin and organic certifications.

- Product innovation also plays an important role in resisting modern trade's pressure to reduce prices, as new products should continue to be launched to meet consumers' demand for healthy and tasty food.

- Traditional recipes and production techniques represent another way to guarantee the quality, differentiate the offerings and claim for a premium price.

Even in traditional foodstuffs, such as dry durum wheat pasta, premium pasta consumption continues to increase with a premium price sustained by characteristics that imply higher quality (e.g., 100% Italian wheat, bronze-drawn, traditional pasta shapes, etc.).

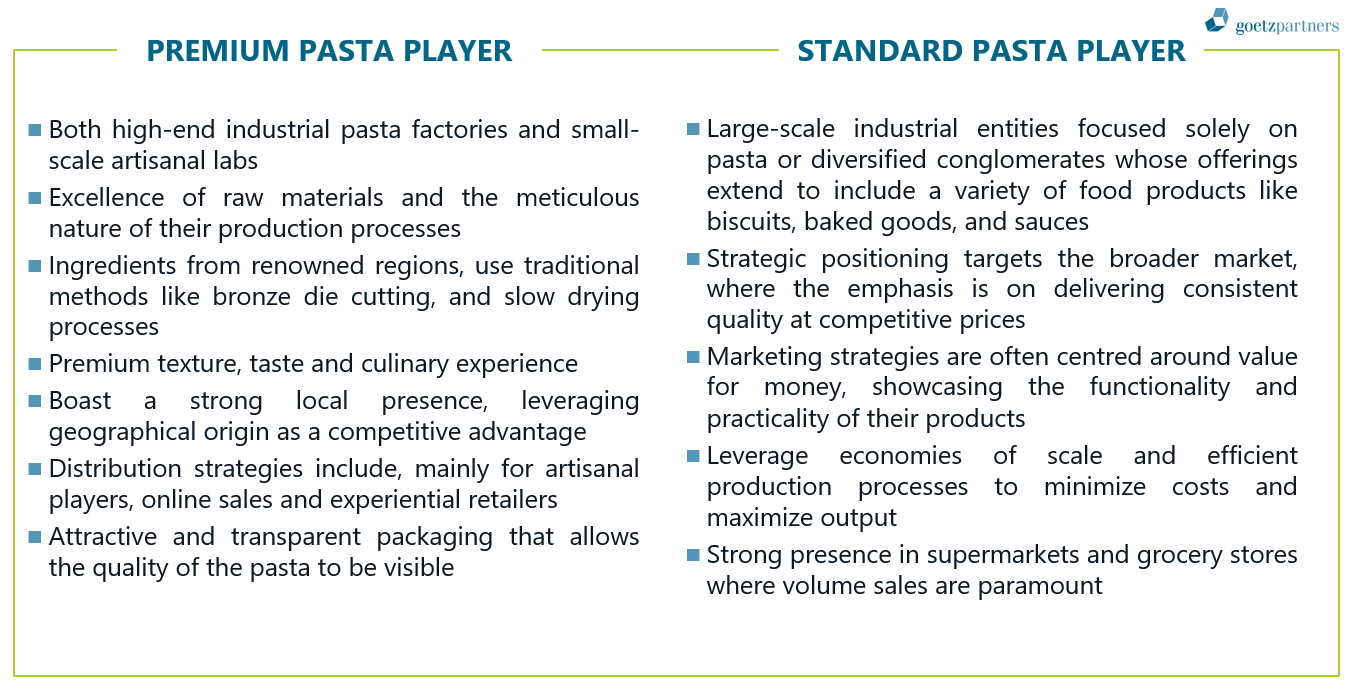

Premium pasta players offer valuable lessons within the food industry underscoring the importance of building a strong brand, fostering customer loyalty, and maintaining a value proposition that justifies premium pricing.

Italian premium brand manufacturers: maintain specificities and consolidate

Current macroeconomic conditions are negatively impacting food expenditure as consumers are experiencing a decline in their purchasing power, but target audience of a premium strategy is mainly composed by affluent consumers which tend to maintain their spending habits even in a downturn. Premium Italian brands should maintain their appeal to these consumers. Italy is the country with the highest number of certified origin products according to EU regulation and one of the richest countries in the world in terms of food and wine culture, with a strong biodiversity and a close link of companies and productions with the territory.

►The Italian agrifood industry should continue to offer a higher quality of food based on our millenary culinary tradition and the associated diet and seize at least in part the enormous untapped potential of foreign markets by making a dimensional leap in export. The consolidation trend pursued in recent years by private equity funds in Italy is changing the supply structure of the sector and will help in exceeding the historical focus on the local market due to the limited scale of most of the Italian agrifood companies.

Navigating Market Expectations

Players who have not invested in the development and communication of a differentiated brand proposition or a clearly distinctive product offering should focus on private labels. A successful business model with a lean cost structure and cost leadership, in particular for companies operating in fast-growing specialty products (e.g. piadina, pinsa, etc.), where the availability of installed capacity is limited.

- Standard and premium players must navigate the expectations of their respective market segments while also keeping an eye on the industry's overarching trends.

- Standard players should continuously seek efficiencies and increase scale and maintain volumes in a higher competitive space where price sensitivities are high.

- Premium producers, meanwhile, face the challenge of maintaining the integrity of their premium offerings in a market where retailers are increasing price pressure, and consumers are more and more knowledgeable and have high expectations. They must ensure that their narratives of quality and exclusivity resonate with the ethos of their target consumers looking for authenticity and a superior gastronomic experience.

Hybrid models are the worst. Food producers without a clear vocation are stuck-in-the-middle and should expect a deterioration of shelf space and/or their margins in the current market conditions.

Summary

The Italian agrifood industry, renowned for its rich culinary heritage, is experiencing a significant transformation. Anchored in tradition yet dynamically adapting to contemporary trends, premium brand manufacturers should align with new consumption patterns. Consumers are prioritizing quality, uniqueness, health and wellness, and a penchant for premium experiences and regional products. Not only the quality and taste but also ethical values associated with food and beverage choices are of paramount importance.

► This strengthening trend paves the way for a consistent premium strategy for the Italian brand manufacturers. Players with a more standard offering should seek efficiencies and increase scale in the more competitive private label space with a coherent cost leadership business model.

Authors:

Giovanni Calia, Managing Director (E-Mail)

Philip Lloyd